Tokocrypto Crypto Exchange Review: Fees, Security, and User Experience

Tokocrypto Fee Calculator

Calculate Your Trading Fees

Enter your trade details below to see how much you'll pay in fees on Tokocrypto.

Your Estimated Fees

For a 0 IDR trade as a , you will pay approximately 0 IDR in fees.

Note: These are estimates based on Tokocrypto's current fee structure. Actual fees may vary slightly due to rounding and market conditions.

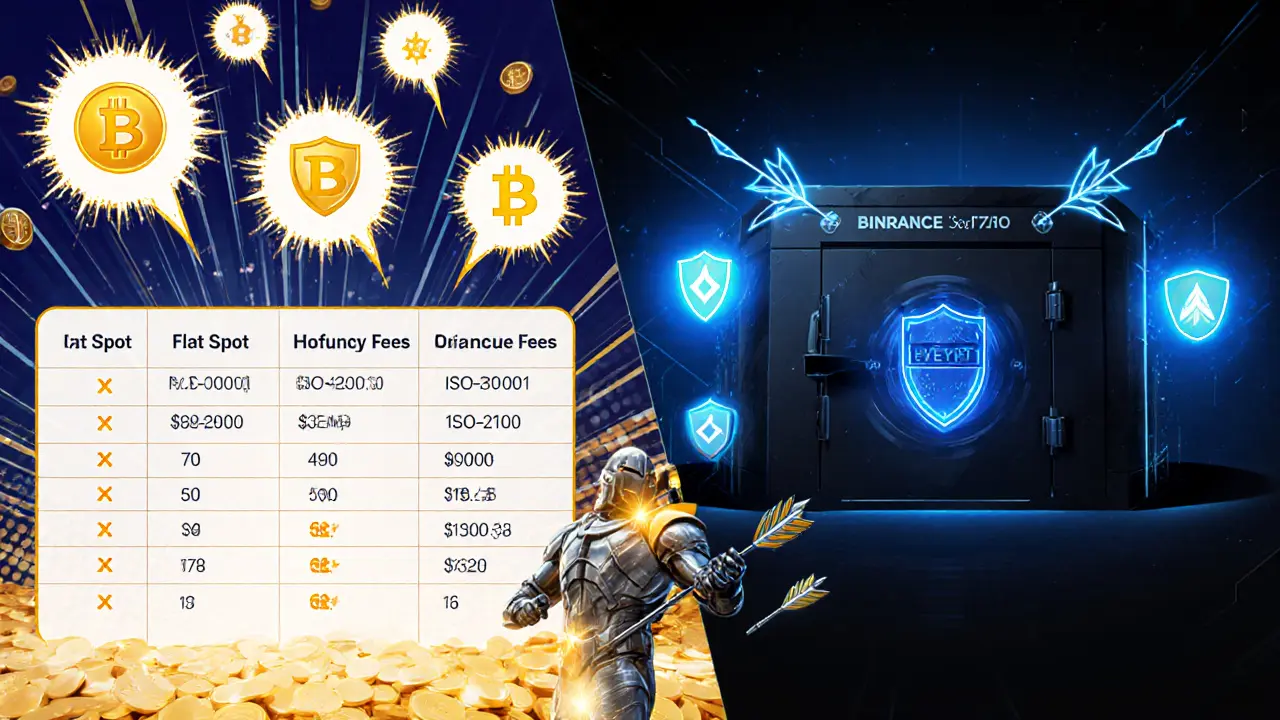

Tokocrypto Fee Structure Overview

| Exchange | Spot Maker Fee | Spot Taker Fee | Futures Fee Range |

|---|---|---|---|

| Tokocrypto | 0.10% | 0.10% | 0.02%-0.04% |

| Binance | 0.10% (VIP 0) | 0.10% (VIP 0) | 0.01%-0.02% |

*Tokocrypto charges a flat 0.10% fee for both maker and taker orders on spot trades. Futures fees vary between 0.02% and 0.04% depending on contract type.

Tokocrypto is a leading Indonesian cryptocurrency exchange that aims to blend the power of a global platform with local market needs. Launched on Binance’s Launchpad in 2018 and fully acquired by Binance in December 2022, the exchange now serves millions of users across the archipelago. This review breaks down what you’ll actually experience on the platform - from fee structures and security protocols to the everyday pain points that keep traders talking.

Why Tokocrypto Matters for Indonesian Traders

Indonesia’s crypto market exploded after the government relaxed regulations in 2022. With over 3.5million downloads on the Google Play Store, Tokocrypto has become the most visible gateway for locals who want to trade Bitcoin (BTC), Ethereum (ETH), and dozens of altcoins using their native currency, the Indonesian Rupiah (IDR). The exchange’s focus on IDR means you can fund your account directly from an Indonesian bank or e‑wallet without converting through a foreign fiat, a convenience that most global exchanges don’t provide.

Core Features at a Glance

- Supported assets: 350‑400 crypto tokens, including BTC, ETH, BNB, USDT, SOL, XRP, DOGE, SHIB, PEPE, and MANTA.

- Order types: market, limit, and stop‑limit orders.

- Trading tools: built‑in Moving Average, Bollinger Bands, and RSI indicators.

- Mobile apps for Android and iOS plus a responsive web portal.

- Local payment options: bank transfers, GoPay, OVO Wallet, and limited credit‑card support.

Fee Structure Compared to the Competition

The fee model is simple: a flat 0.10% maker and taker fee on spot trades. For futures, fees range from 0.02% to 0.04% depending on contract type. Below is a quick side‑by‑side look at how Tokocrypto stacks up against Binance, the platform that powers its backend.

| Exchange | Spot Maker Fee | Spot Taker Fee | Futures Fee Range |

|---|---|---|---|

| Tokocrypto | 0.10% | 0.10% | 0.02%-0.04% |

| Binance | 0.10% (VIP0) | 0.10% (VIP0) | 0.01%-0.02% |

Tokocrypto’s flat fees are transparent and sit comfortably below the industry average, which many analysts cite as around 0.15% for spot trading. The slight premium on futures versus Binance reflects the platform’s more limited leverage options.

Security Measures and Certifications

Security is a top concern for any crypto exchange. Tokocrypto leans on Binance’s infrastructure while adding its own safeguards:

- ISO 27001 and ISO 27701 certifications for information security and privacy management (ISO 27001, ISO 27701).

- Cold‑storage custody powered by Ceffu, using multi‑party computation (MPC) and zero‑trust authentication.

- Two‑factor authentication (2FA), address whitelisting, and anti‑phishing codes for every withdrawal.

- Regular third‑party penetration tests and audit reports released to the public.

Despite these layers, independent rating sites like TradersUnion still give Tokocrypto a low overall risk score (2.83/10), mainly because operational reliability - not security - has been shaky.

Withdrawal Experience - The Real Deal

Withdrawal speed is where the exchange’s reputation takes the biggest hit. Users report:

- Bitcoin withdrawal fee: 0.0005BTC (below the global average of 0.0006BTC).

- Typical processing time: 24‑48hours, but many complaints cite delays up to 5days during peak demand.

- Manual review triggers: large withdrawals, mismatched wallet addresses, or KYC re‑verification.

For comparison, Binance often processes BTC withdrawals within an hour once the network confirms. The slower pace on Tokocrypto appears tied to its manual compliance checks and limited staffing in customer support.

User Support - Where It Falters

Tokocrypto advertises 24/7 chat support, but real‑world feedback tells a different story. Trustpilot averages a 2.3/5 rating, highlighting:

- Long response times (averaging 48hours for ticket resolution).

- Generic canned replies that rarely address specific account issues.

- Escalation bottlenecks for withdrawal disputes.

That said, the platform’s Tokocrypto Academy receives praise for free crypto courses, especially among beginners looking for structured learning.

Regulatory Landscape and Compliance

Operating under Indonesia’s BAPPEBTI regulator, Tokocrypto holds Permit No.03/BAPPEBTI/PFAK/092024, officially labeling it a Prospective Physical Trader of Crypto Assets. This registration means the exchange must adhere to anti‑money‑laundering (AML) rules, report large transactions, and maintain a transparent order book.

Compliance provides a safety net for users, but it also adds layers of verification that can slow down account onboarding and withdrawals.

Who Should Consider Tokocrypto?

Based on the data above, here are three quick personas and whether Tokocrypto fits:

- Beginner Indonesian trader: enjoys easy fiat‑on‑ramp, free education, and low fees - but must accept slower withdrawals.

- Professional day trader: appreciates technical analysis tools and high liquidity via Binance’s backend, yet may outgrow limited leverage and support speed.

- Institutional investor: values ISO certifications and custody via Ceffu, but would likely need a more robust SLA for withdrawals.

Pros, Cons, and Bottom Line

| Pros | Cons |

|---|---|

| Flat 0.10% spot fee | Slow withdrawal processing (24‑48h+) |

| Full IDR fiat support and local bank integration | Customer support often delayed |

| ISO 27001 & ISO 27701 certifications | Lack of leveraged trading options |

| Free educational resources via Tokocrypto Academy | Limited credit‑card deposit methods |

Overall, Tokocrypto shines as the most locally‑friendly exchange in Indonesia, but its operational hiccups keep it from rivaling truly global platforms. If you value convenience over speed, it can be a solid first step into crypto.

Next Steps for Prospective Users

- Download the Android or iOS app and complete KYC verification (passport, selfie, proof of address).

- Fund your account via an Indonesian bank transfer or GoPay - the minimum deposit is IDR50,000 for IDR balances.

- Explore the Academy’s free courses to grasp basic concepts before placing real trades.

- Start with a small spot trade (e.g., BTC/IDR) to test withdrawal speed.

- If you hit performance limits, consider diversifying a portion of your portfolio to a global exchange for faster withdrawals.

By following these steps you’ll minimize surprises and get a realistic feel for how Tokocrypto operates day‑to‑day.

Frequently Asked Questions

Is Tokocrypto safe for storing large amounts of crypto?

The exchange holds ISO 27001 and ISO 27701 certifications and uses Ceffu’s MPC cold‑storage for the bulk of user funds. While the technical security is strong, operational issues like delayed withdrawals can pose risks if you need quick access to large sums.

Can I trade futures on Tokokrypto?

Yes, the platform offers futures contracts with fees ranging from 0.02% to 0.04%. However, leverage options are more limited than on Binance, and the user interface is geared toward spot trading.

What fiat currencies can I use on Tokocrypto?

Indonesian Rupiah (IDR) is the only fiat supported for deposits and withdrawals. The exchange integrates with local banks and e‑wallets like GoPay and OVO.

How does Tokocrypto’s fee compare to Binance?

Both charge a flat 0.10% spot fee for regular users. Binance can reduce fees further with higher trading volume (VIP tiers), while Tokocrypto’s fee stays constant regardless of volume.

Why are withdrawals slower on Tokocrypto?

The platform conducts manual compliance checks for large or irregular withdrawals, which adds time. Limited staffing in customer support also slows down the verification of withdrawal requests.

17 Comments

John Kinh

December 3 2024Honestly, the fees look decent, but I doubt anyone cares. 🤷♂️

Nathan Blades

December 7 2024Whoa, this Tokocrypto breakdown really lights a fire under me! The flat 0.10% fee might seem modest, but when you scale up those trades, it adds up fast.

Think about the futures range: 0.02%‑0.04%-that's actually competitive with the big players.

Security-wise, they’re not tossing out any wild promises, just a solid standard.

If you’re new, the fee calculator on the site is a handy tool, no need to guess.

Bottom line: it's a respectable platform for both newbies and seasoned traders alike.

Debby Haime

December 11 2024Great rundown! For anyone puzzling over the fee structure, remember that the maker‑taker split doesn’t exist here-both are 0.10% on spot, which simplifies budgeting.

Also, the futures fee tier is quite low, especially if you stay within the usual contract types.

Just keep an eye on market volatility; fees can feel higher when spreads widen.

katie littlewood

December 15 2024Reading through this review feels like strolling through a well‑curated garden of exchange insights, each blossom representing a facet of Tokocrypto’s ecosystem.

First, the fee architecture-flat 0.10% for both maker and taker on spot-acts as a level playing field, sparing traders the headache of tiered calculations.

While some platforms flaunt tiered discounts, this simplicity can be a breath of fresh air for newcomers who dread the math.

Moving onto futures, the 0.02%‑0.04% range is impressively tight, especially when juxtaposed with competitors where the spread can widen dramatically during high‑volume periods.

Security, the holy grail of any exchange, is addressed with standard industry practices; however, the review could benefit from a deeper dive into audit reports and custody solutions.

The user experience shines through the fee calculator widget-intuitive, responsive, and a real time‑saver for those who prefer on‑the‑fly estimations.

Nevertheless, the UI could use a touch more polish; occasional latency in loading the table detracts from the otherwise smooth flow.

For traders focused on cost efficiency, Tokokrypto’s transparent fee model is a compelling proposition, but don’t overlook the importance of liquidity depth, which can affect slippage.

In markets where volume is king, a thin order book may erode the benefits of low fees.

On the upside, the exchange’s integration with local payment methods lowers entry barriers for Indonesian users, a strategic advantage in that region.

For global traders, however, the limited range of fiat gateways might pose a hurdle, nudging them toward more universally accessible platforms.

Community support appears active, though the review doesn’t elaborate on response times; a quick look at forum threads suggests a generally helpful staff.

In summary, Tokocrypto offers a balanced mix of fee transparency, decent security posture, and a user‑friendly interface, making it a solid choice for both beginners and seasoned traders alike.

Just remember to monitor liquidity and keep an eye on any future updates to fee structures, as exchanges often tweak them in response to market dynamics.

Jenae Lawler

December 19 2024While the article paints Tokocrypto in a decidedly favorable hue, one must not overlook the gravitas of regional monopolies that stifle competition.

It is patently evident that the superficial parity of fees with global behemoths merely masks underlying infrastructural deficiencies.

Such platforms, under the guise of "accessibility," often impose covert barriers that erode market integrity.

Therefore, prospective participants should scrutinize regulatory compliance beyond the superficial veneer presented.

Chad Fraser

December 22 2024Hey folks, love seeing the breakdown! If you’re just getting started, use that fee calculator – it’s super handy.

Don’t forget to secure your account with 2FA; a little extra step saves a lot of trouble later.

Happy trading and keep an eye on those futures fees; they’re surprisingly low.

Parker Dixon

December 25 2024Great points, Chad! Adding to that, the exchange’s API documentation is actually pretty solid, which is a boon for algo traders.

Also, topping up your IDR balance can be done swiftly via local banks, cutting down the friction you’d face on Western exchanges.

Bobby Ferew

December 27 2024Okay, let’s unpack the jargon a bit. The “flat 0.10%” sounds sleek, but when you factor in hidden spreads on low‑liquidity pairs, the effective cost can balloon.

Also, “security” is a buzzword unless they publish third‑party audits; otherwise, it’s just marketing fluff.

celester Johnson

December 30 2024Interesting observation, Bobby. One could argue that the perceived simplicity of a flat fee is, in fact, a strategic veil – a philosophical statement on transparency that may conceal deeper inefficiencies.

Nevertheless, the true cost of trading is often measured not in percentages but in the lost opportunity when slippage eats your margins.

Prince Chaudhary

January 2 2025Tokocrypto’s fee simplicity is a great stepping stone for newcomers; just remember to verify the exchange’s KYC procedures and keep your personal data safe.

Mark Camden

January 5 2025Allow me to clarify a common misconception: a 0.10% fee does not automatically make an exchange superior. One must consider the total cost of ownership, including withdrawal fees, network fees, and latency.

In my experience, many traders overlook these ancillary expenses, leading to suboptimal profitability.

Evie View

January 9 2025Honestly, the article glosses over the real pain points – the lack of advanced order types and the occasional downtime during peak market stress.

Sidharth Praveen

January 11 2025True, Evie. For those who value reliability, it’s worth monitoring the platform’s uptime stats before committing large capital.

Sophie Sturdevant

January 13 2025From a risk‑management standpoint, integrating sophisticated order types-like stop‑limit and OCO-into the UI would dramatically improve hedging capabilities for professional traders.

Somesh Nikam

January 16 2025Indeed, Sophie, the absence of such features can be a bottleneck. Implementing them with clear documentation would align Tokocrypto with industry best practices. 😊

Jan B.

January 18 2025Chad’s tip on 2FA is spot‑on; it’s a small step that prevents big headaches.

MARLIN RIVERA

January 20 2025The review is overly optimistic; it fails to address the platform’s latency issues and the limited range of supported assets, which are critical drawbacks.