Crypto Regulations, Scams, and DeFi Tokens in November 2025

When it comes to crypto regulations, government rules that force exchanges to report user data and control mining operations. Also known as cryptocurrency compliance, it's no longer about if you’ll be tracked—it’s about how deeply. In November 2025, India moved closer to enforcing the OECD’s Crypto-Asset Reporting Framework, forcing exchanges to hand over user data by 2027. Meanwhile, Venezuela made mining a state-controlled job, requiring licenses and forcing miners into government pools. These aren’t suggestions—they’re laws that change how you hold, trade, and report crypto.

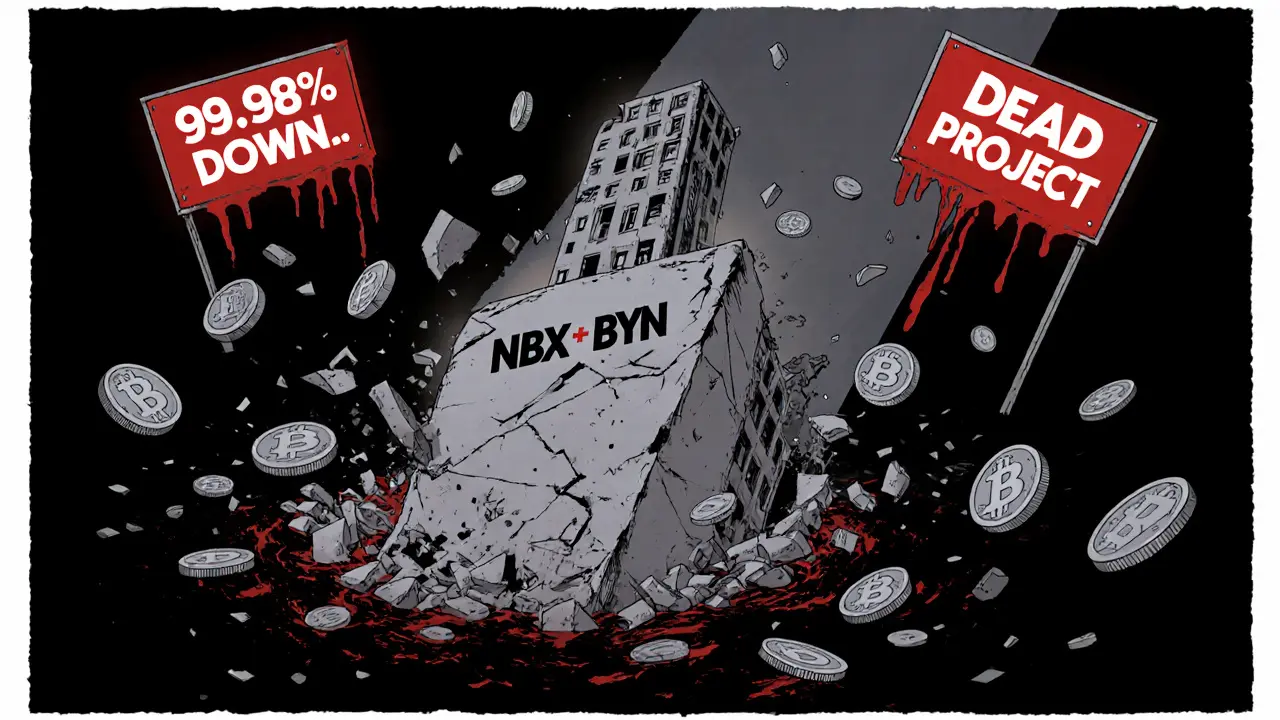

DeFi tokens, digital assets that give holders voting power and access to lending, swapping, or yield platforms. Also known as governance tokens, they’re supposed to empower users—but too often, they’re just digital ghosts. Radiant Capital (RDNT) lets you lend across blockchains without bridges. Velodrome v3 on Optimism offers 45% APY bribes and low fees. But NBX (BYN) trades at $0.0009 with no team or website. HUNNY FINANCE crashed 99%. Parallel Finance abandoned users’ assets. These aren’t just price drops—they’re proof that not all DeFi is built to last. Holding a governance token should mean something. Too many just mean you own a ticket to nowhere.

crypto scams, fraudulent projects designed to steal money through fake utility, fake teams, or fake airdrops. Also known as rug pulls, they’re the dark side of crypto’s innovation. Bullit (BULT) claims to be decentralized storage but has zero trading volume and impossible price targets. Hollywood Capital Group’s WOR token crashed 99.5% with no real team. OC Protocol has zero circulating supply after six years. Myanmar-based networks stole $10 billion using romance scams and forced labor. And fake airdrops for ECIO, RARA Unifarm, and Cannumo? They’re not opportunities—they’re traps. If it sounds too good to be true, it’s not a chance. It’s a countdown to loss.

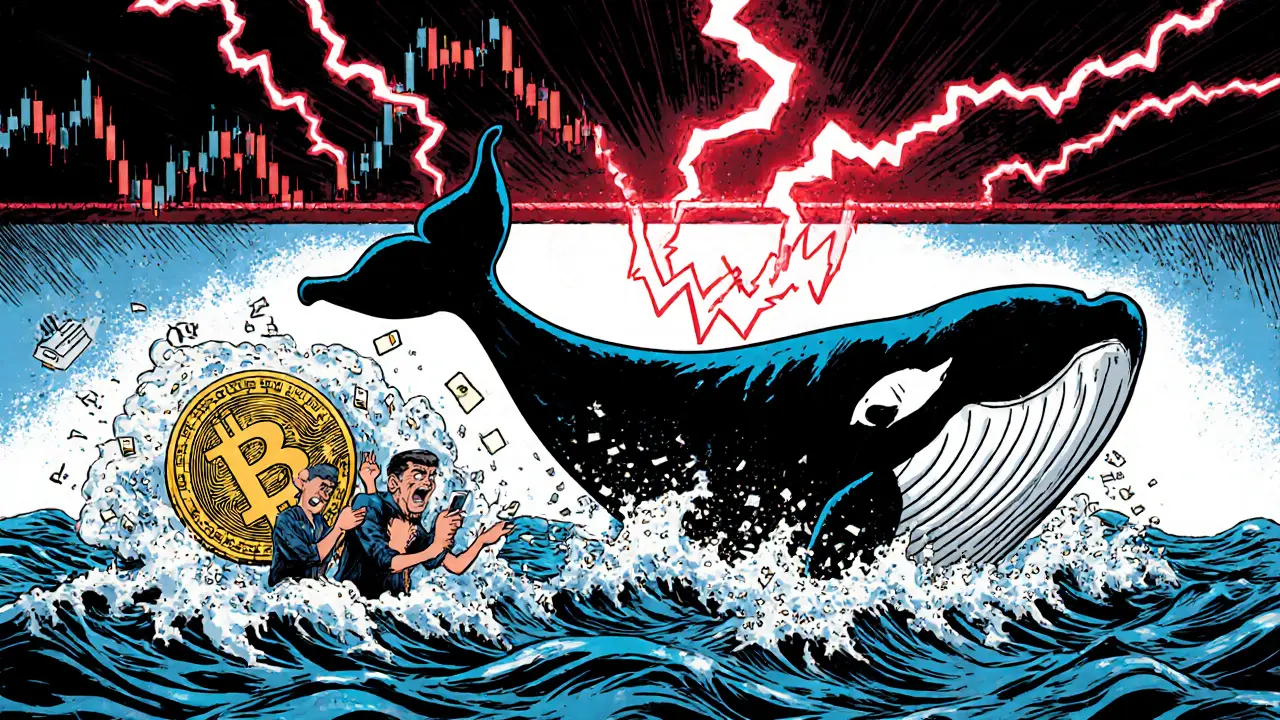

This collection doesn’t sugarcoat anything. You’ll find deep dives on how whales manipulate markets, how to avoid getting ripped off in an airdrop, and why some exchanges are safe while others are ticking bombs. You’ll learn how block rewards slow inflation, why priority fees matter, and how to spot a zombie token before you buy it. No fluff. No hype. Just what’s real, what’s broken, and what you need to know before you trade.

India will implement the OECD's Crypto-Asset Reporting Framework in 2027, requiring exchanges to share user crypto data globally. Here's what it means for taxpayers, exchanges, and the future of crypto in India.

Continue Reading

Cryptify AI (CRAI) is an Ethereum-based token powering an AI platform that tracks influencer marketing ROI in crypto. With renounced contract, staking rewards, and monthly buybacks, it's a high-risk, niche project with real utility but low adoption so far.

Continue Reading

Bullit (BULT) claims to be a decentralized storage coin, but its data is inconsistent, trading volume is near zero, and its price includes impossible future highs. It lacks code, team, or real use - avoid this high-risk token.

Continue Reading

Learn how to identify whale manipulation in crypto markets-spot spoofing, stop hunting, and fake breakouts before they wipe out your positions. Understand the tactics big players use and how to protect yourself.

Continue Reading

Blockchain.com is a trusted, regulated crypto exchange perfect for beginners and long-term holders. With strong security and simple design, it's ideal for buying Bitcoin and Ethereum safely-though support is slow and altcoin options are limited.

Continue Reading

HTX crypto exchange offers 700+ coins, 200x leverage, and DAO governance, but has slow KYC and no U.S. support. A powerful tool for active traders, not beginners.

Continue Reading

Radiant Capital (RDNT) is a cross-chain DeFi lending protocol that lets users deposit and borrow assets across multiple blockchains without bridges. Learn how RDNT works, its risks, and whether it's worth using.

Continue Reading

No official Cannumo (CANU) airdrop has been confirmed yet, but you can prepare now by using a dedicated wallet, joining their community, and avoiding scams. Learn what to look for and what to ignore in 2025.

Continue Reading

WOR crypto is a fraudulent token pretending to revolutionize film with blockchain. It has no real team, no partnerships, and a 99.5% price crash. Experts call it a scam. Avoid it.

Continue Reading

Holding governance tokens gives you real voting power in DeFi and DAOs, letting you influence fees, treasury spending, and protocol upgrades. It aligns your interests with the network’s success and offers rewards beyond price gains.

Continue Reading

NBX (BYN) is a nearly dead DeFi token that peaked at $5 in 2021 and now trades at $0.0009. With no team, no website, and zero adoption, it's a zombie project with less than 0.5% chance of recovery.

Continue Reading

Learn how priority fees and miner tips affect your blockchain transaction speed. Understand Ethereum’s EIP-1559 system, Bitcoin’s fee model, and how to set the right tip to avoid delays and wasted money.

Continue Reading