Cryptocurrency: Real‑Time Insights, Tools, and Strategies

When diving into Cryptocurrency, a digital asset that uses cryptographic security and operates on decentralized ledgers. Also known as digital currency, it enables borderless payments, tokenized assets, and new financial models. Understanding Cryptocurrency means grasping its core components, from mining incentives to regulatory shifts, and it sets the stage for deeper topics like Crypto Exchange, platforms where users trade digital assets, Airdrop, free token distributions used to boost network adoption, and Crypto Tax, the legal framework for reporting crypto gains and losses. Below we’ll connect these pieces, so you can see how they influence each other and why they matter today.

How Exchanges Shape the Crypto Landscape

Every Crypto Exchange acts as a gateway, turning raw market data into actionable trades. Key attributes include fee structures, security protocols, and liquidity depth. For example, a low‑fee exchange lowers entry barriers for beginners, while high‑liquidity venues give professionals the confidence to execute large orders without slippage. Security features like two‑factor authentication and cold‑storage safeguards user funds, which directly impacts market confidence. As you explore our exchange reviews, notice how each platform’s design choices affect overall market health and user experience.

On the flip side, airdrops inject fresh tokens into the ecosystem, often sparking short‑term price spikes. The core attribute of an Airdrop is its eligibility criteria—holding a certain token, completing a task, or participating in a community event. These campaigns can boost a project's visibility, but they also bring risk if the token lacks utility. Understanding the tokenomics behind each airdrop helps you separate genuine community incentives from hype‑driven giveaways.

Tax compliance is another pillar that cannot be ignored. Crypto Tax rules vary by jurisdiction, but the common attributes are reporting obligations, cost‑basis calculations, and classification of income versus capital gains. New reporting forms like the IRS 1099‑DA require detailed transaction logs, pushing traders to adopt portfolio trackers. By mastering these tax basics, you avoid costly penalties and keep more of your profits.

Privacy remains a hotly debated attribute in the crypto space. Privacy‑focused coins employ zero‑knowledge proofs or ring signatures to hide transaction details, while surveillance tools aim to trace flows for compliance. This tug‑of‑war shapes regulatory approaches and influences user adoption. When choosing a wallet or exchange, consider how much anonymity you need versus how regulators might view your activity.

All these entities—exchanges, airdrops, tax, and privacy—interact in a dynamic web. A robust exchange supports seamless airdrop claims, which in turn generate taxable events, while privacy solutions protect user data during these processes. By the end of this section, you’ll have a clearer picture of how each piece fits together, giving you the context you need to navigate the articles below. Let’s move on to the curated guides, reviews, and analyses that dive deeper into each of these topics.

The Shield DAO SLD airdrop in 2021 rewarded only real contributors - testnet users, bug hunters, and community members. Learn how it worked, why tokens went unused, and how it differs from today’s airdrop models.

Continue Reading

DEX trading fees and slippage can cost you more than you think. In 2026, gas fees, slippage, and routing costs often make decentralized exchanges more expensive than centralized ones - unless you know how to optimize them.

Continue Reading

No official Dream Card NFT airdrop has been announced yet, but X World Games has a history of rewarding active players. Learn how to prepare, what to watch for, and why holding your NFTs matters ahead of Dream Card v3.

Continue Reading

ChimpySwap is a tiny DeFi exchange on Binance Smart Chain with a $2,000 market cap and zero transparency. Here's why you should avoid it-and what to use instead.

Continue Reading

Tunisia enforces one of the world's strictest crypto bans, with prison sentences up to five years for trading or mining. Banks block all transactions, customs seize equipment, and even holding crypto carries legal risk. There are no legal loopholes.

Continue Reading

The Biconomy BIT airdrop in 2022 distributed 2.4 billion tokens to active users. Today, BIT still offers fee discounts, voting rights, and rewards on Biconomy Exchange. Its value lies in utility, not speculation.

Continue Reading

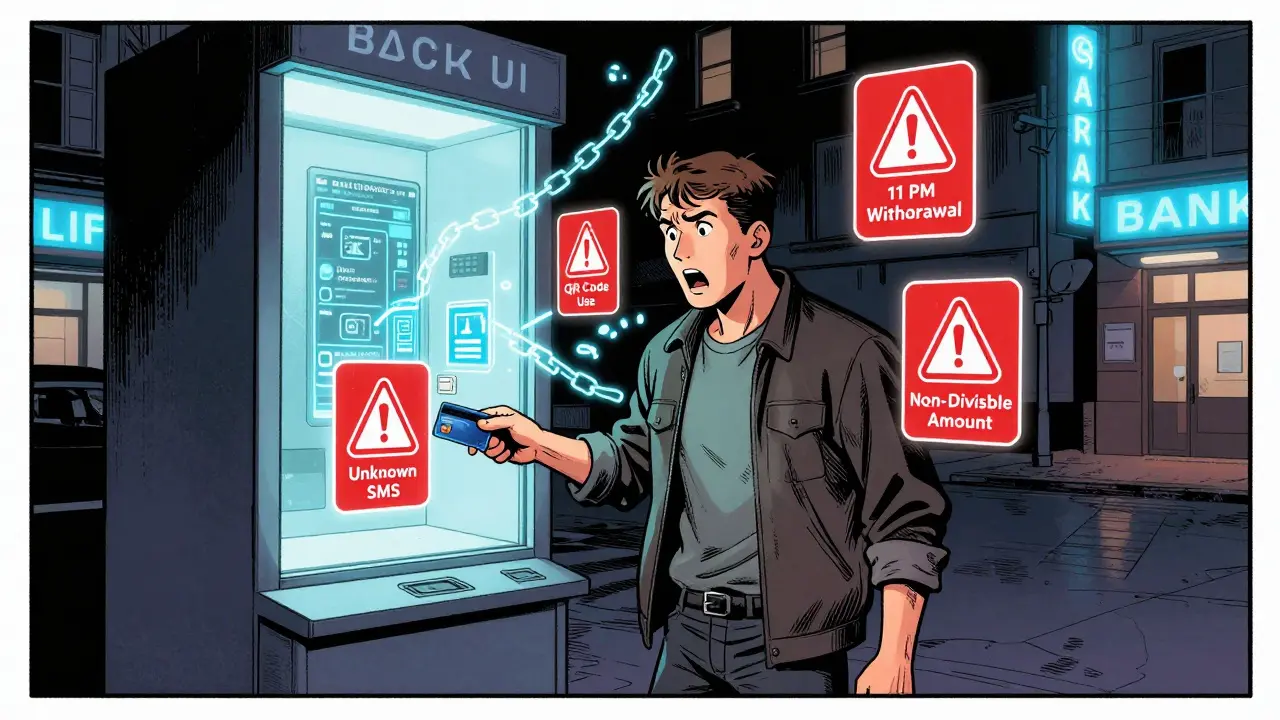

Russian banks now block crypto-to-fiat withdrawals using automated flags and 48-hour limits. If you try to cash out, expect scrutiny, documentation demands, and account freezes - all part of a broader strategy to control money flow under sanctions.

Continue Reading

Learn how to stake crypto safely and earn passive rewards without technical overload. Compare exchange staking, pools, and self-custody options - plus real risks like slashing and lock-ups.

Continue Reading

TDM crypto was marketed as a fitness token tied to a 3-million-user app, but it's now worth 99.9% less than its peak, has zero trading volume, and no real use. Here's why it's a dead project.

Continue Reading

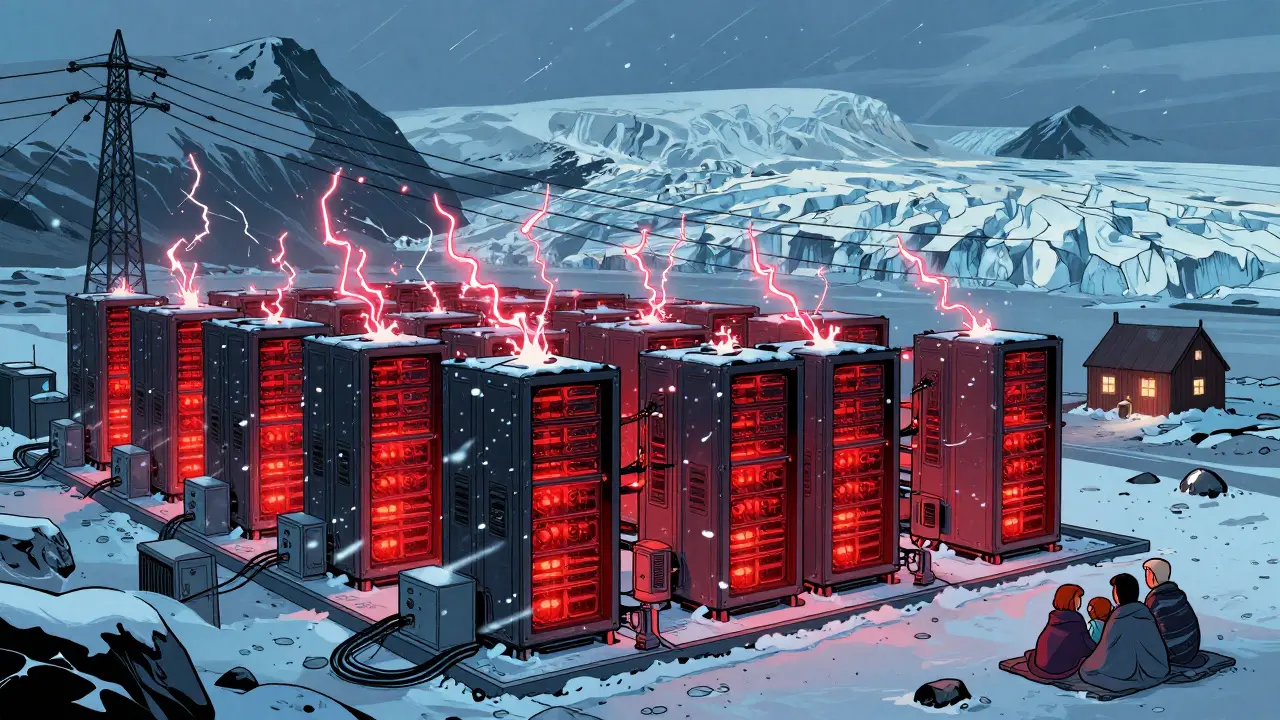

Iceland's national power company has imposed strict energy limits on cryptocurrency mining to prevent grid overload. Miners must now meet efficiency standards, report usage, and prove they use renewable energy. The move isn't a ban-it's a reset.

Continue Reading

NFT token standards define how unique digital assets work on blockchains. ERC-721 started it all, but ERC-1155 improved efficiency. Different blockchains like Solana and Flow have their own standards. Understanding these helps avoid high fees and compatibility issues. This guide breaks down key standards and their real-world impacts.

Continue Reading

Safuu 2.0 (SAFUU) promises 102,800% APY but current data shows minimal liquidity, inconsistent pricing, and unsustainable returns. Learn the hard facts behind this DeFi token and why experts advise extreme caution.

Continue Reading