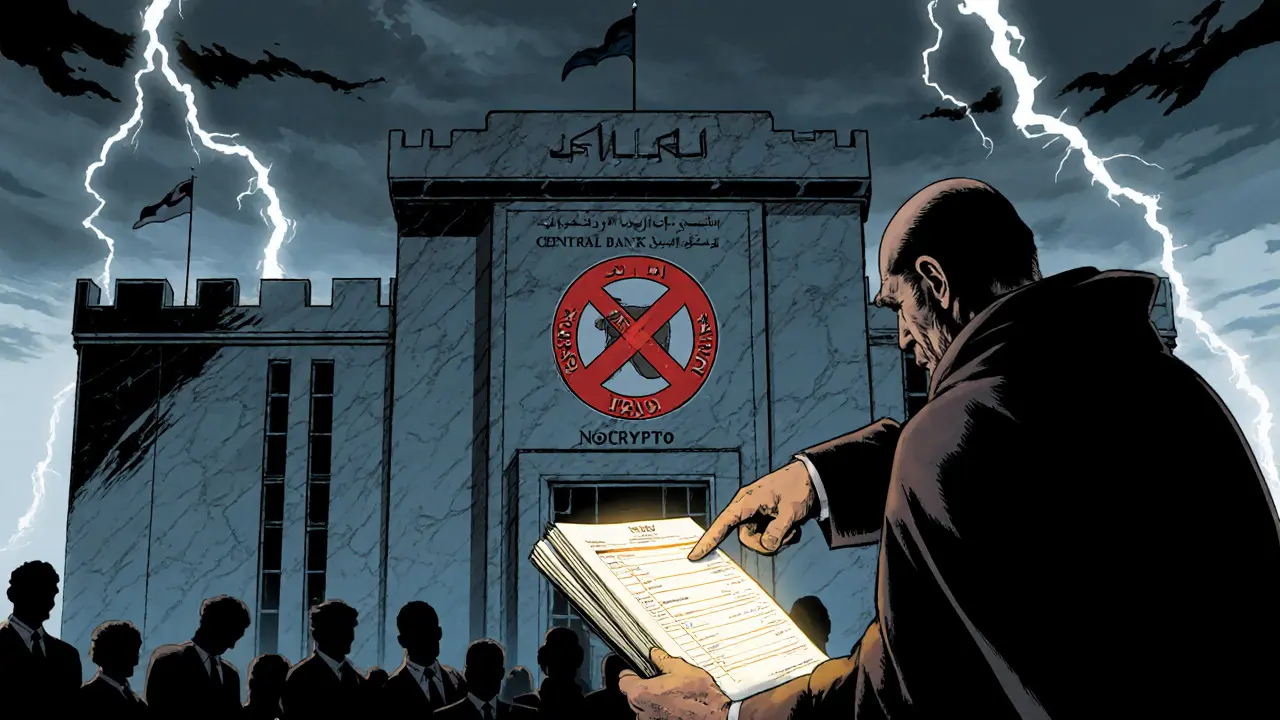

Understanding the Central Bank of Iraq's Crypto Restrictions and Future CBDC Plans

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue ReadingWhen people talk about CBDC Iraq, a central bank digital currency being explored by Iraq’s central bank to modernize its financial system. Also known as a digital dinar, it’s not just a tech upgrade—it’s a potential rewrite of how money flows in a country still recovering from decades of instability. Unlike Bitcoin or other cryptocurrencies, a CBDC isn’t decentralized. It’s issued and controlled by the central bank, just like physical cash, but in digital form. That means the Central Bank of Iraq would have full oversight: tracking transactions, setting limits, and even freezing funds if needed. It’s not about freedom—it’s about control, efficiency, and security.

Why now? Iraq’s economy still relies heavily on cash, which is hard to monitor, easy to counterfeit, and expensive to distribute. With over 40% of the population underbanked, a digital currency could help bring people into the formal economy. Imagine receiving government aid directly to your phone, paying taxes without waiting in line, or sending money across borders without paying 10% in fees. That’s the promise. But it’s not just Iraq. Countries like China with its digital yuan, Nigeria with the eNaira, and Sweden with its e-krona are all testing similar systems. The difference? Iraq is starting from scratch. There’s no existing digital infrastructure to build on. No widespread smartphone access. No trust in institutions. That’s the real challenge.

What’s missing from the headlines? Most reports focus on whether Iraq will launch a CBDC. But the real question is: How will it work for ordinary people? Will it require a government ID? Will it replace cash entirely? Can you use it offline? Will foreign remittances still go through traditional channels? These aren’t theoretical questions—they’re daily life issues. And the answers will determine if this becomes a tool for inclusion or another layer of control.

Behind every CBDC is a web of legal, technical, and political decisions. Iraq’s plan likely involves working with foreign tech firms, choosing between blockchain or centralized databases, and deciding how much privacy users get. Compare that to El Salvador’s Bitcoin experiment—where the government pushed adoption without fixing basic infrastructure—and you see how risky this move is. A failed CBDC doesn’t just waste money. It erodes trust in the entire financial system.

Below, you’ll find posts that dig into real-world digital currency experiments, the tech behind central bank systems, and how countries like Turkey and the Philippines are handling similar shifts. Some show success. Others are cautionary tales. None of them are theoretical. They’re all happening right now—and Iraq is watching closely.

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue Reading