Cryptocurrency Supply: What It Means and Why It Matters

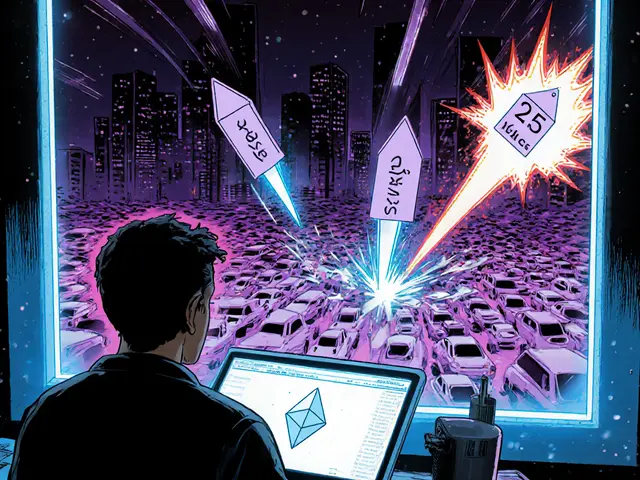

When you hear cryptocurrency supply, the total number of coins or tokens that exist or will ever exist in a blockchain network. Also known as tokenomics, it’s the hidden engine behind whether a coin goes up, crashes, or disappears. It’s not just about how many coins are out there—it’s about who controls them, when they’re released, and whether they’re even usable.

Take OC Protocol (OCP), a crypto coin with a hybrid blockchain that’s been active since 2018 but has zero circulating supply. That means no one owns it. No one can trade it. It’s a ghost token. Then there’s KaiChain (KAI), a token tied to AI workflows with minimal trading volume and low community adoption. Its supply might look healthy on paper, but without real users, it’s just data. These aren’t edge cases—they’re warnings. Cryptocurrency supply only matters if it’s actually in circulation. A high max supply means nothing if the tokens are locked, burned, or hoarded by insiders.

Behind every coin is a supply structure: circulating supply, the number of coins currently available and trading in the market, tells you what’s real. total supply, all coins created so far, including those locked or reserved, shows you the full picture. And max supply, the absolute cap on how many coins will ever exist, is what gives some coins their scarcity value—like Bitcoin’s 21 million limit. But if a project never releases its tokens, or if it’s controlled by a handful of wallets, the supply number is meaningless. That’s why you see coins like HUNNY FINANCE crash 99%—supply isn’t just about quantity, it’s about trust, distribution, and real demand.

Some coins are designed to inflate endlessly. Others are built to shrink over time. And then there are scams—projects that promise huge supplies but never let you touch the tokens. The posts below dig into real examples: coins with zero supply, tokens locked in dead exchanges, airdrops that don’t exist, and how supply manipulation hides behind flashy marketing. You’ll see what separates real projects from empty shells—and how to spot the difference before you invest.

Block rewards in Bitcoin are programmed to halve every four years, creating a predictable, declining inflation rate that contrasts sharply with fiat currencies. This mechanism is key to Bitcoin's value as a scarce digital asset.

Continue Reading