FCA Stablecoin Rules

When diving into FCA stablecoin rules, the regulatory framework the UK's Financial Conduct Authority imposes on digital stablecoins. Also called FCA’s stablecoin framework, it directly impacts how stablecoins are created, sold, and monitored.

The Financial Conduct Authority designed these guidelines to bring clarity to a market that often feels like the Wild West. By defining who qualifies as a “stablecoin” and what capital buffers are needed, the FCA creates a predictable environment for both startups and legacy finance firms. FCA stablecoin rules also require issuers to publish a clear redemption plan, ensuring holders can swap tokens for fiat on demand.

Key Pillars of the FCA Stablecoin Framework

One pillar is consumer protection. The regulator insists that stablecoin providers maintain a 100 % reserve of liquid assets, so a token’s price stays pegged to its underlying currency. This reduces the risk of sudden de‑pegging, a problem seen in several high‑profile failures last year. Another pillar covers AML/KYC compliance. Issuers must run robust Know‑Your‑Customer checks and report suspicious activity, aligning with the UK’s broader anti‑money‑laundering strategy.

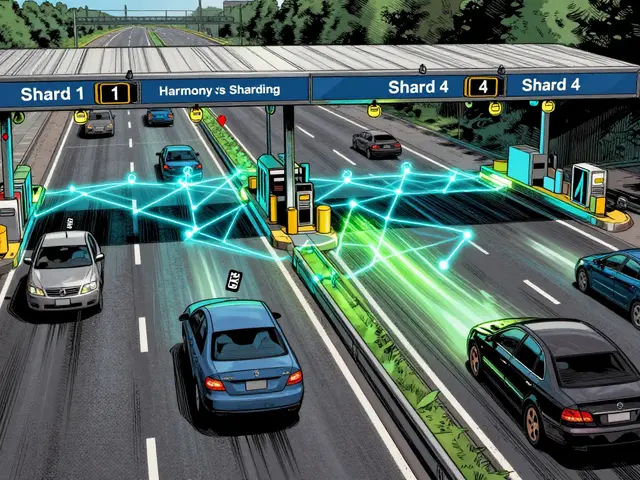

Beyond protection, the rules touch on market integrity. The FCA demands transparent pricing and real‑time reporting of reserves, which helps exchanges and custodians verify token backing. This transparency also makes it easier for auditors to spot irregularities early, limiting systemic risk. For developers, the framework clarifies which token designs qualify as “e‑money” versus “crypto‑assets,” shaping decisions about tokenomics and smart‑contract architecture.

From a business perspective, the guidelines create a cost structure that can be forecasted. Companies know the exact capital adequacy ratios they must hold, the reporting cadence, and the licensing fees involved. This removes the guesswork that previously deterred many smaller players from entering the stablecoin space. At the same time, larger banks see a clear pathway to launch their own digital pounds, leveraging the same rules to build trust with regulators and customers alike.

Regulators outside the UK are watching closely. The FCA’s approach influences the European Union’s MiCA draft and the US Treasury’s discussions on stablecoin oversight. When the UK sets a high bar for reserve management and AML controls, other jurisdictions often adopt similar standards to avoid being left behind in cross‑border crypto trade.

Below you’ll find a curated set of articles that break down each element of the rulebook, compare the UK stance with global trends, and offer practical steps for issuers, traders, and compliance teams. Dive in to see how the FCA stablecoin rules are reshaping the crypto landscape today.

Explore the UK’s ambitious plan to become a global crypto hub, covering the two‑phase regulatory roadmap, key policies, political shifts, and what the changes mean for investors and businesses.

Continue Reading