Russia Crypto Ban: Impact, Risks, and Workarounds Explained

When dealing with Russia crypto ban, the set of restrictions imposed by Russian authorities on crypto trading, transfers and services. Also known as Russian cryptocurrency prohibition, it affects investors, exchanges, and everyday users alike. These measures are part of broader cryptocurrency bans, governmental actions that limit or forbid crypto activities in a jurisdiction, which aim to control capital flows and curb financial risk.

The ban doesn’t just disappear; it pushes activity into the underground crypto market, a network of unregulated platforms and peer‑to‑peer channels where crypto is traded despite legal prohibitions. In 2025, premiums on Bitcoin and major altcoins rose 12‑18% in these shadow venues, reflecting the higher risk and limited liquidity. This premium effect illustrates the semantic triple: Russia crypto ban drives higher premiums in the underground crypto market. For a trader, that means paying more to buy the same coin, and for a regulator, it signals a widening compliance gap.

Governments respond with tighter regulatory enforcement, actions such as fines, licensing revocations, and criminal investigations targeting illegal crypto operations. The 2025 crackdown saw over 30 exchange operators fined across Russia, a clear example of the triple: cryptocurrency bans increase regulatory enforcement pressure. Enforcement isn’t limited to borders; banks freeze accounts, and AML tools flag crypto‑related transactions, making it harder for ordinary users to move funds without attracting attention.

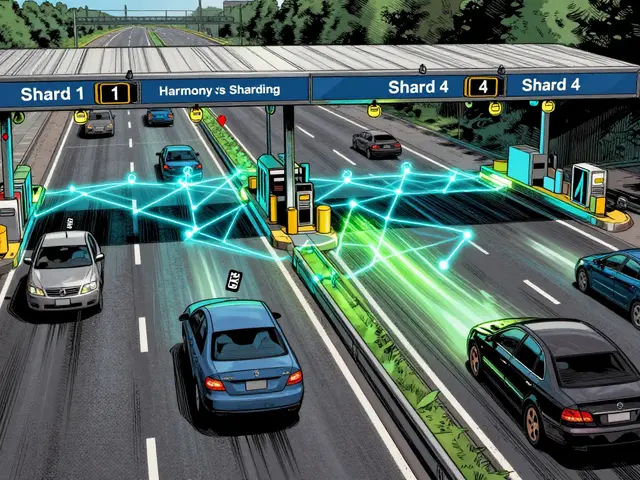

At the same time, the law provides a narrow legal corridor: cross‑border Bitcoin payments, the limited use of Bitcoin for international transfers under a pilot framework approved by the Central Bank of Russia. This exception creates a semantic link: cross‑border Bitcoin payments offer a legal workaround to the ban. Companies that qualify can settle invoices overseas, but they must register with the central bank, maintain strict reporting, and only use the approved protocol. For most traders, the pilot remains out of reach, nudging them toward riskier underground routes.

From a risk‑management perspective, the ban reshapes three key attributes of crypto activity: liquidity, price stability, and compliance cost. Liquidity drops as legitimate exchanges shut down, causing price spikes in the underground market. Stability erodes because fewer participants amplify price swings, while compliance cost skyrockets as firms invest in legal counsel and monitoring tools. The combined effect is a higher overall risk premium that investors must factor into any position.

If you’re navigating this environment, start with a clear checklist: verify your exchange’s licensing status, use a VPN only if it’s legal in your location, and keep transaction records for tax reporting. Consider diversifying into assets that face fewer restrictions, such as stablecoins approved for settlement under the pilot. Also, watch for official updates—regulatory frameworks evolve quickly, and a new exemption could appear as soon as the next legislative session.

Looking ahead, the ban may tighten or loosen depending on political pressure and economic needs. Some analysts predict that Russia could relax certain rules to attract foreign capital, while others see a hardening stance to control capital flight. Regardless of the direction, the underlying dynamics—underground market premiums, enforcement intensity, and limited legal channels—will continue shaping how crypto is used in the country.

Below you’ll find a curated collection of articles that break down each of these angles in detail. From deep dives on underground market pricing to step‑by‑step guides on complying with cross‑border Bitcoin rules, the posts will give you the actionable insight you need to stay ahead despite the ban.