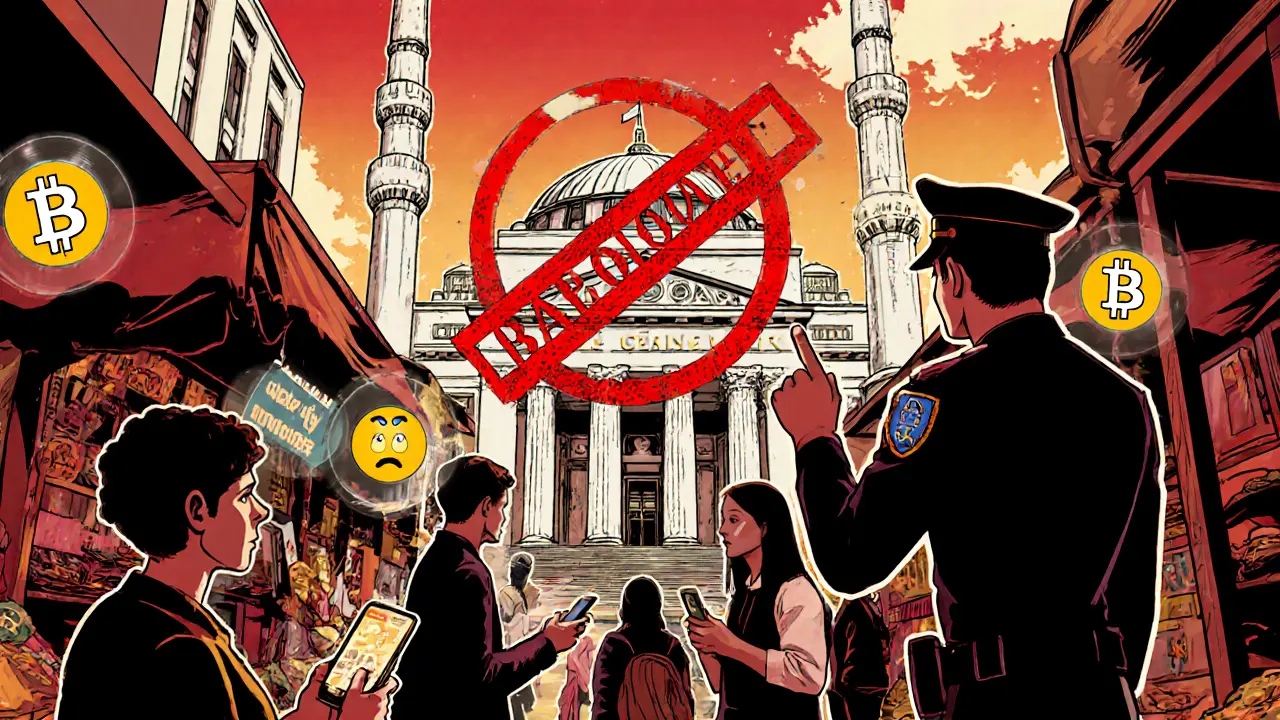

Turkey crypto regulation: how the 2024 law reshaped the market

Explore how Turkey’s 2024 crypto law reshaped trading, licensing, and enforcement, and what it means for users and businesses.

Continue ReadingWhen dealing with Turkey crypto regulation, the set of rules governing how digital assets can be bought, sold, and used within Turkey's borders. Also known as Turkish cryptocurrency law, it blends central bank directives, tax codes, and anti‑money‑laundering (AML) standards to create a legal framework that affects everyone from casual traders to large exchanges.

The Central Bank of the Republic of Turkey (CBRT), Turkey's monetary authority that issues guidelines on crypto‑related activities plays a pivotal role. It issues warnings, monitors market stability, and influences licensing requirements for crypto platforms. In practice, Turkey crypto regulation requires exchanges to register with the Financial Crimes Investigation Board, enforce KYC checks, and report suspicious transactions – a clear example of how AML compliance shapes the local market.

The broader Turkish financial regulations, laws covering securities, banking, and taxation in Turkey intersect with crypto rules, especially when it comes to capital gains tax. The tax authority treats crypto gains as other income, meaning traders must report profits on their annual filings. This tax requirement dovetails with AML obligations, creating a dual responsibility for users and service providers.

Meanwhile, cryptocurrency exchanges, platforms that facilitate buying, selling and trading of digital assets must obtain a license from the Banking Regulation and Supervision Agency (BRSA). They need to implement robust security measures, maintain segregated accounts, and adhere to transaction monitoring standards. These exchange licensing rules illustrate how Turkey crypto regulation encompasses both financial oversight and consumer protection.

Putting it all together, the regulatory ecosystem can be summed up in a few semantic triples: Turkey crypto regulation encompasses exchange licensing; Turkey crypto regulation requires AML compliance; the CBRT influences tax treatment of digital assets. Understanding these connections helps you navigate the market confidently, whether you're planning to launch a new token, trade Bitcoin on a local platform, or simply keep your tax records straight.

Below, you’ll find a curated collection of articles that break down each piece of this puzzle – from detailed exchange reviews to tax guidance and compliance checklists – giving you actionable insights to stay ahead in Turkey's evolving crypto scene.

Explore how Turkey’s 2024 crypto law reshaped trading, licensing, and enforcement, and what it means for users and businesses.

Continue Reading